And then this happens. An unanticipated turmoil breaks out and one can hear the shattering sounds of all kinds of crystal balls exploding, smashing all well laid out plans into smithereens. 30 / 60 / 90 day forecasts go for a toss, as do annual plans and budgets.

The question then pops up: what do the Executive Management, the CFO and his team turn to. Who or what will guide them to base their plans?

Elementary, my dear Watson. The answer lies within.

In the insights we gain from the data available within the enterprise: insights about customers, suppliers and vendors, values, volumes, rates, trends – things that the enterprise managers handle on a daily basis.

This has one very important pre-requisite though. To be able to visualise, to be able to create the understanding, the CFO and the Finance Team need to come out of the rut of the periodic closing and reporting cycles and concentrate on creating and sharing regular insights on the various business drivers.

This CFO and Finance initiative would be the decoding of the Enigma that will decrypt the signals emanating out of the data, enabling the enterprise to take pre-emptive action before the situation impacts the operations and results. This is not to say that the macroeconomic data should be totally ignored. This should happen within the overall macroeconomic framework canvas.

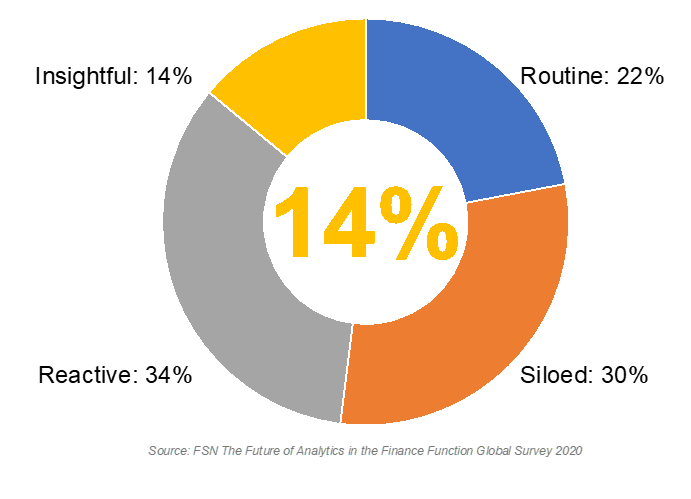

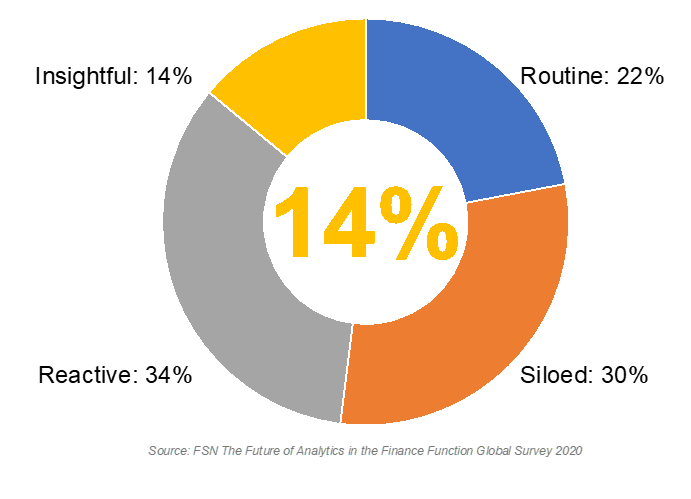

Now for some more amazing facts gleaned from a FSN Survey: only 14% of the Finance Functions in the enterprises surveyed could prepare Reports & Analytics and deliver in the true sense.

Not surprising at all: a Gartner survey highlighted that only 13% of the organisations could identify performance issues before they hit the financials.

More often than not, the Executive Management and more specifically the CFOs and their key team members track the macroeconomic benchmarks like some kind of crystal ball to guide the enterprise on its way forward. Elaborate plans are made, budgets are drawn, broken down into strategies, tactics and tasks for execution based on what the crystal ball of macroeconomic indicators foretell.

22% of the respondents focused only on “Routine” reporting – cyclical reports. The analysis was restricted to standard Excel reports and reports from the ERP system. Each operating function prepared their own reports and analysis.

For 30% of the respondents, there was no “organisational” or “enterprise level” Business Intelligence and Data Visualisation. Reporting was “Siloed”.

34% worked with “Reactive” reports: meaning they normally worked with the “Routine” reports but prepared analysis on an ad-hoc basis whenever a need was felt to offer extra insights or in extreme or exceptional situations.

And finally, only 14% of Finance Functions really stepped up to the enterprise level requirements. They worked with an analytical approach to enterprise-wide data, used not only financial but also non-financial data in an integrated approach, made extensive use of analytical tools intelligently to deliver vital inputs to support data-based decision making to drive strategy and tactics that could respond to the situation decisively and successfully.

Business Leadership today needs much more than fragmented and random inputs and insights to be able to be successful.

The quality, periodicity and timing of Reports & Analytics that their CPM solution can deliver, makes the vital difference in dynamic situations like what organisations are facing today. And this is a key shortcoming in many CPMs.

With the right kind of Reports & Analytics backed up by a proactive Finance Function that is not just stuck in the cyclical reporting rut, CFOs can make a telling contribution to the success of their organisation.

Acknowledgements: OneStream Software, FSN The Future of Analytics and Gartner

Prakash Subramaniam

Executive Director & Head: Customer Success

AMCO Solutions – APAC